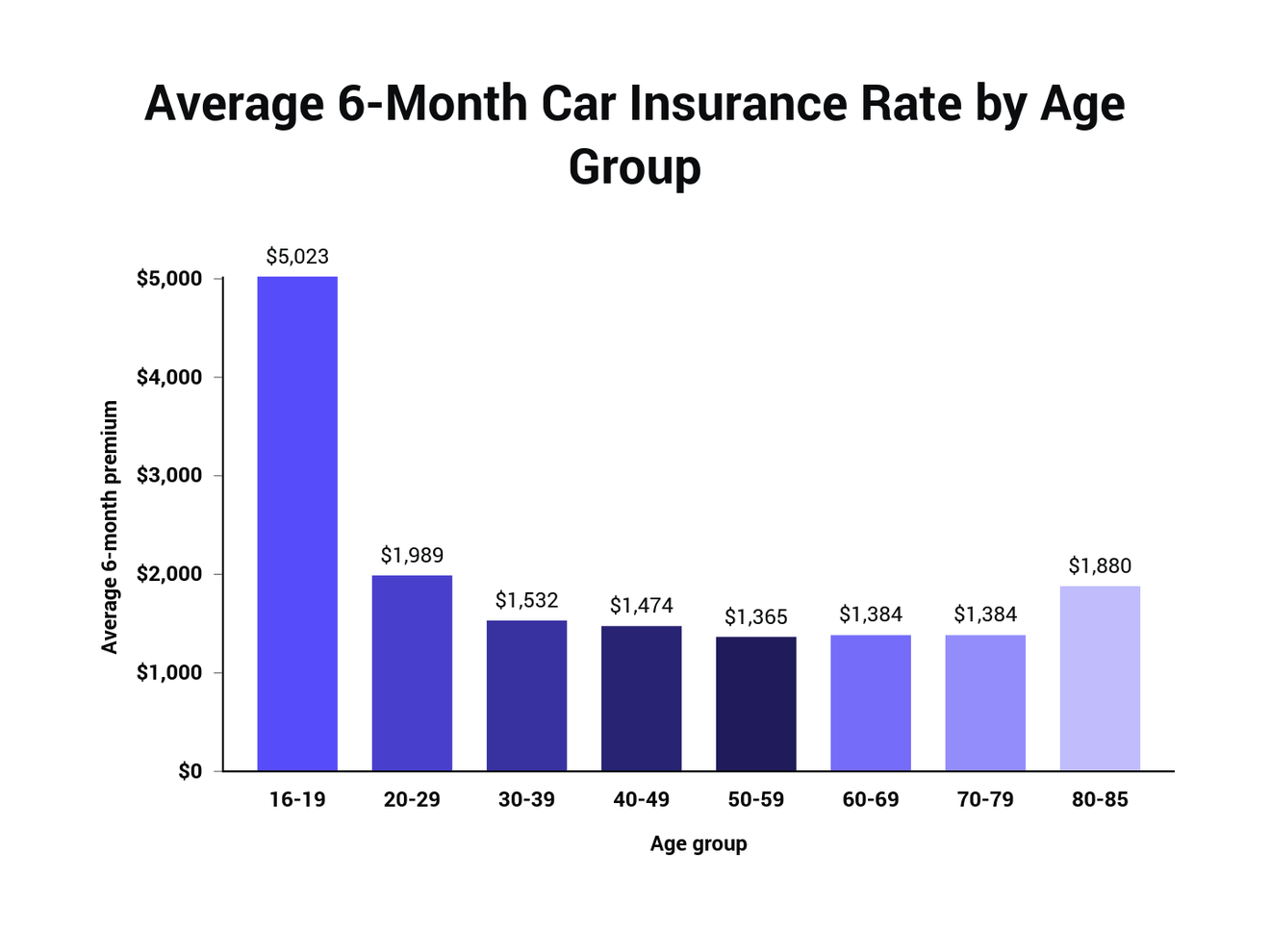

Allstate Insurance Rate Increase 2025. Farmers increased by 34.7%, followed by allstate at 30%, and. Fortunately, there are ways you can help.

From 2018 to december 2025, several auto insurers have seen cumulative percentage increases in their rates. Allstate’s annual average rate is over $1,300 higher at $3,374.

Cfo jess marten said the insurer will be implementing rate increases of 30%, 14.6%, and 20% in the respective states beginning december, with effective dates.

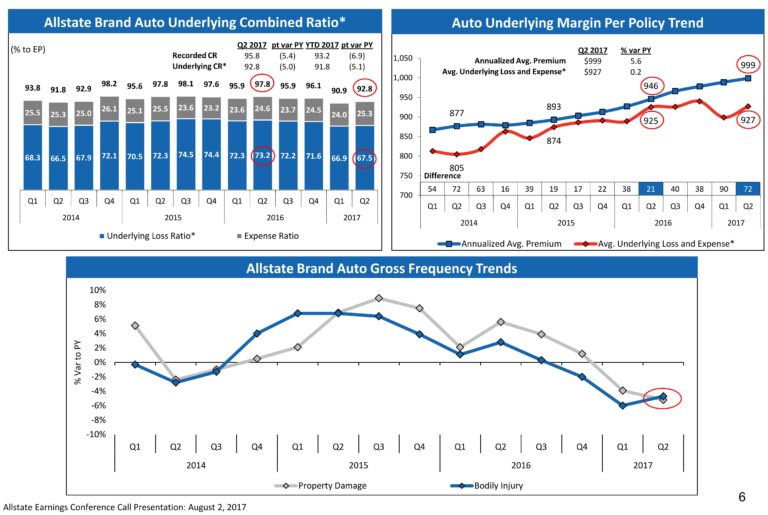

Allstate says auto claims frequency, insurance rate increases leveling, Allstate is hiking homeowners insurance rates by 12.7% this week, while state farm is planning a 12.3% increase in may, according to separate state filings by. In fact, these factors resulted in an increase in average annual home insurance premiums to $1,754 in 2025, according to policy genius.

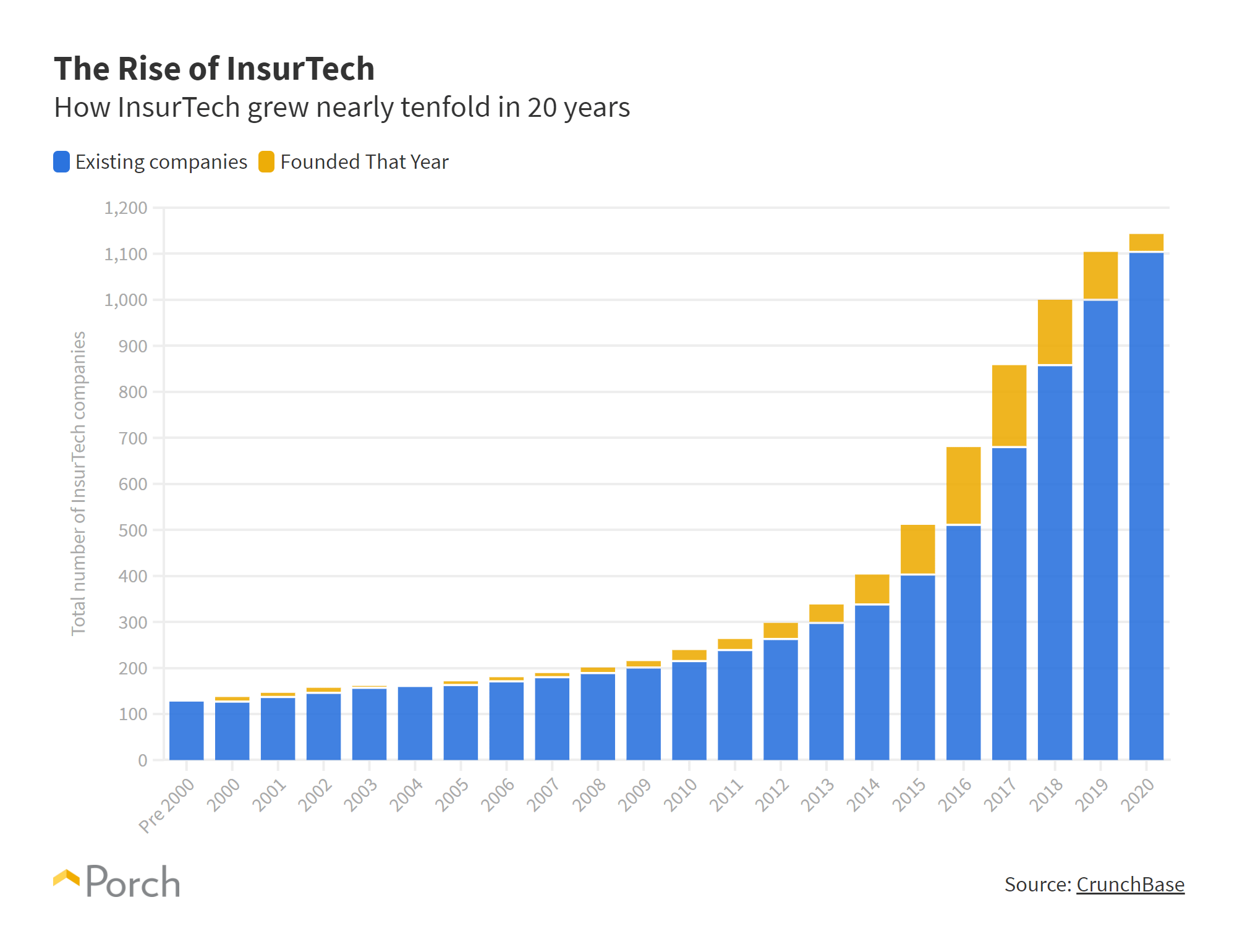

5 Key Insurance Industry Trends (20212024), This means in just 20 months, allstate auto insurance rates have surged by 60%, from an average of $1,700 to a startling $2,732 per year. Allstate plans to continue increasing auto insurance rates in at least 10 states in 2025, including new jersey and new york, where the company received double.

Allstate pursues auto insurance rate increases in bid to return to, Allstate is hiking homeowners insurance rates by 12.7% this week, while state farm is planning a 12.3% increase in may, according to separate state filings by. These car insurance costs show the.

Allstate Auto Insurance 2025 Review Great Discounts, Allstate secures approval to raise auto insurance rates in three states; Average premium in february 2025:

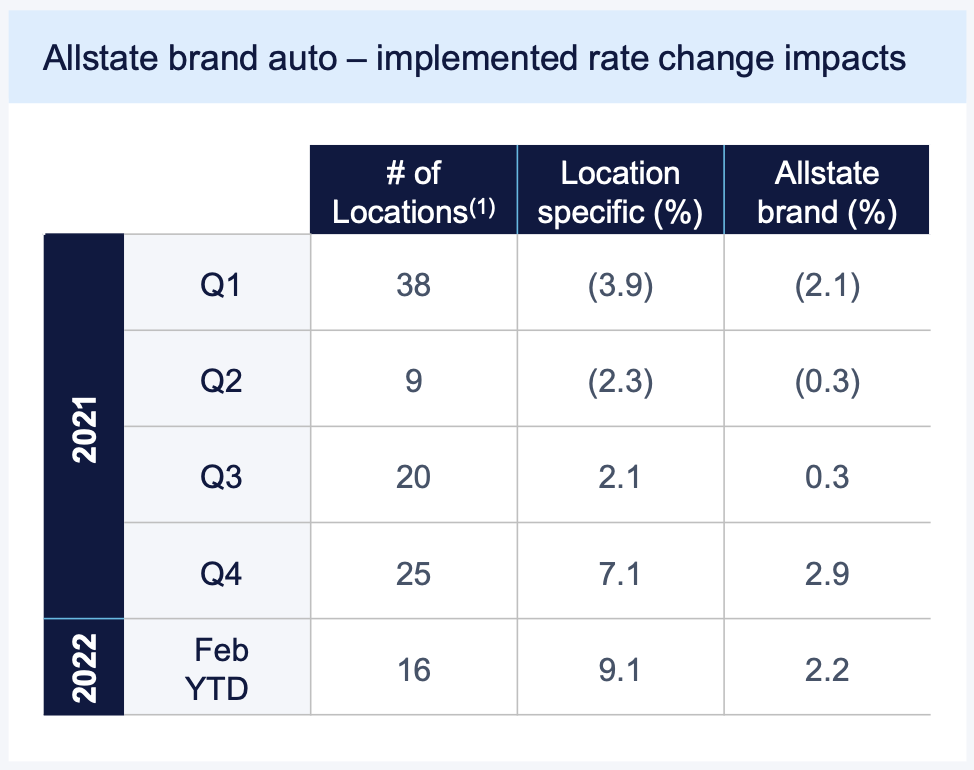

Car Insurance Industry Statistics in 2025 The Zebra, During the month of january, rate increases for allstate brand auto insurance resulted in a premium impact of 1.4%, which are expected to raise annualized written premiums by approximately $363 million, and rate increases for allstate brand. Implemented rate increases and inflation in insured home replacement costs resulted in a 12.1% increase in homeowners insurance average gross written.

Insurance rate increase Nationwide, Allstate, USAA, Liberty Mutual, Cfo jess marten said the insurer will be implementing rate increases of 30%, 14.6%, and 20% in the respective states beginning december, with effective dates. Allstate is the most expensive at $3,000 a year.

Allstate Granted DoubleDigit California Automobile Insurance Rate, Allstate is hiking homeowners insurance rates by 12.7% this week, while state farm is planning a 12.3% increase in may, according to separate state filings by. Car insurance rates are up almost 21% for the 12 months ended in february, according to new consumer price index data released tuesday.

Allstate® Insurance Review, During the month of january, rate increases for allstate brand auto insurance resulted in a premium impact of 1.4%, which are expected to raise annualized written premiums by approximately $363 million, and rate increases for allstate brand. Average premium in february 2025:

Allstate reports 1.4B loss for 2025; increases rates, policy, This means in just 20 months, allstate auto insurance rates have surged by 60%, from an average of $1,700 to a startling $2,732 per year. Bad times roll on for personal auto segment

Allstate adding auto insurance policies near Geico pace Crain's, Allstate secures approval to raise auto insurance rates in three states; Rate increases • pursuing rate actions • pricing expertise and.

Implemented rate increases and inflation in insured home replacement costs resulted in a 12.4% increase in homeowners insurance average gross written.